Scan QRCode

McKinsey will hold a media day in Shanghai on November 27, 2025, with the theme of how companies can win in the future Chinese market and successfully break through overseas markets, sharing their latest insights on the prospects of the Chinese economy, the globalization trend of Chinese enterprises, and the ways to win in key industries.

On site group photo

(from left to right: Guan Mingyu, Senior Managing Partner of McKinsey Global and Head of McKinsey China Automotive Consulting Business; Wang Wei, Senior Managing Partner of McKinsey Global, Head of McKinsey Asia Digital Consulting Business, and Global Co Leader of McKinsey Global E-commerce Consulting Business; Ni Yili, Chairman of McKinsey China; Wang Jin, Senior Managing Partner of McKinsey Global and Head of McKinsey China Life Sciences and Healthcare Consulting Business; Karel, Senior Managing Partner of McKinsey Global and Head of McKinsey China Human Resources, Organization, and Performance Consulting Business)

Eloot))

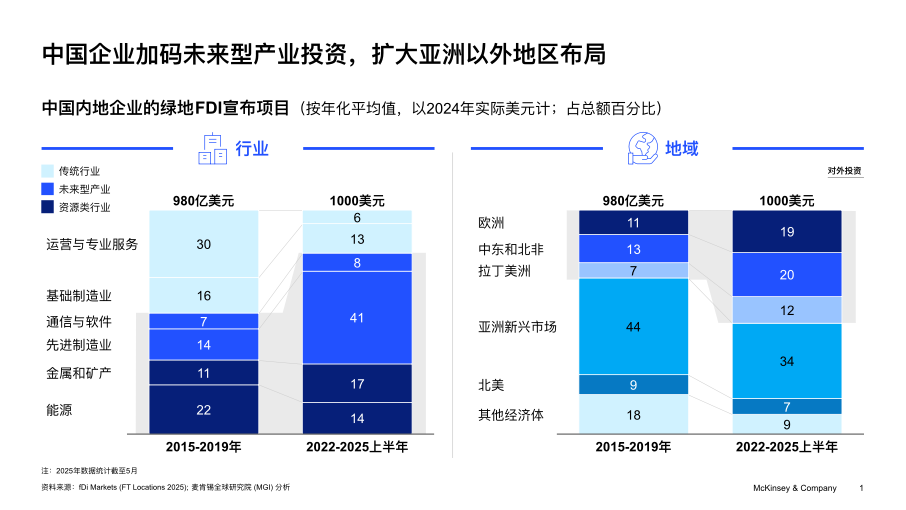

At the macroeconomic level, the latest research report released by McKinsey Global Institute (MGI) recently titled "Reshaping the Pattern of Foreign Direct Investment: How Current Investment Affects Future Industry and Trade Trends" points out that global capital flows are undergoing structural reshaping. China is steadily transforming from a major recipient of foreign direct investment (FDI) to a key investor with global influence. Chinese companies are shifting their investment strategies, with capital deployment in Europe, Latin America, and the Middle East and North Africa growing by over two-thirds. This strategic adjustment highlights China's increasing influence as a global investor and reflects its strategic evolution in building and integrating into new value chains in key regions around the world. Since 2022, the average annual amount of green space investment attracted by China has decreased by 65% compared to before the pandemic; However, during the same period, China's outward investment in future oriented industries and resources increased by 54%. This shift not only declares a new era for FDI patterns, but also forces multinational corporations to re-examine their existing strategies and build more flexible global action frameworks to optimize their layout and competitive positioning in the new global landscape.

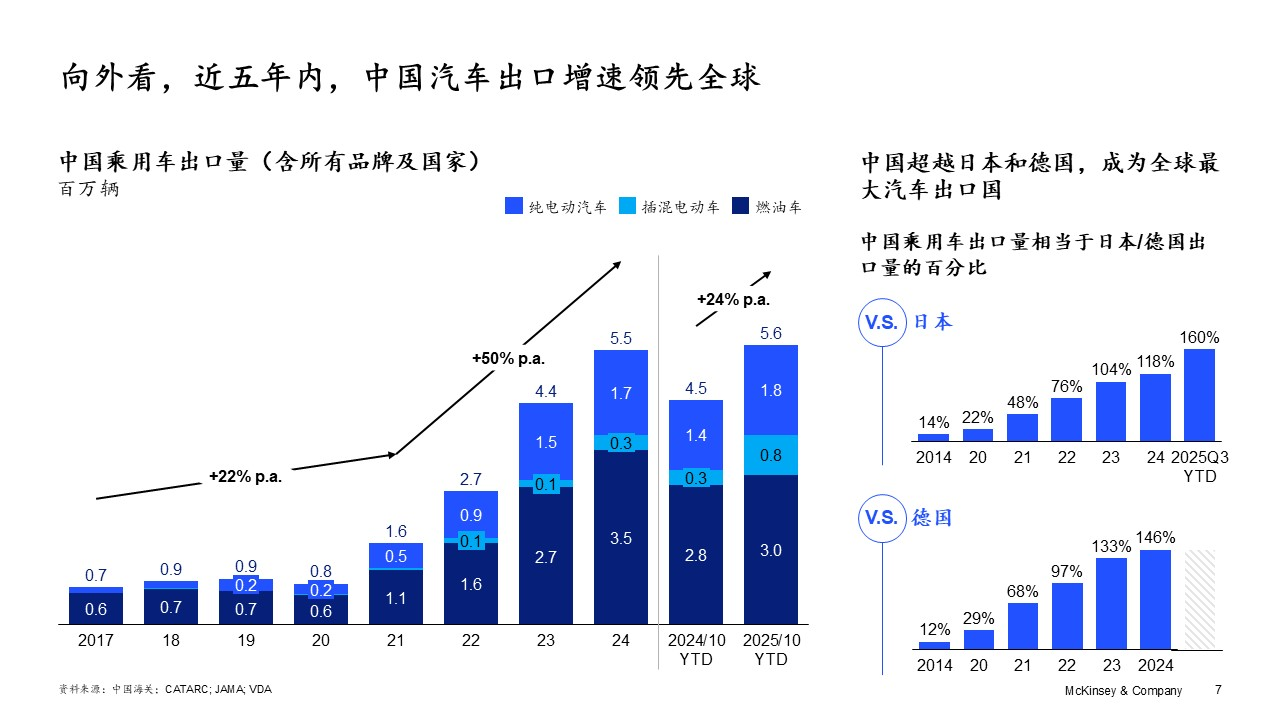

Jeongmin Seong, President of McKinsey Global Institute in China and Managing Partner of McKinsey Global, said, "Our latest research shows that China's investment strategy is focusing on future industries such as electric vehicles, batteries, and key minerals. In these core areas, China's outward investment continues to grow and has steadily transformed from a 'net investment country' to a 'net investment country'. This change has put forward new requirements for multinational enterprises: redefining China's strategy, not only to formulate plans within China, but also to evaluate the profound impact of Chinese capital and capabilities on the competitive landscape on a global scale." Winning China's New Chapter - Chinese Enterprises' Globalization of the Automotive Industry In the past decade, China's automotive industry has undergone a transformation from a 'market for technology'. The strategic shift towards' Technology Enters the World '. Since 2010, China has firmly held the position of the world's largest automobile market, but the real turning point occurred in the past five years: with its advantages in the field of electrification, Chinese brands have gained about 30% market share from multinational joint venture brands in the local market. This' easy formation of attack and defense 'not only established the leading position of Chinese car companies in the local market, but also accumulated strong momentum for their global rise. McKinsey previously predicted that by 2030, the number of Chinese car companies among the top ten global car companies is expected to increase to 3-5, and the market share of Chinese brands in overseas core markets is expected to reach 10% -20%. In 2025, two Chinese car companies will enter the top ten global sales for the first time. It is expected that China's car exports this year will set a record for the highest annual export volume of a single country in the history of the global automotive industry, officially surpassing Japan and Germany to become the world's largest car exporting country, achieving a milestone breakthrough.

For the new stage of globalization of Chinese car companies, Guan Mingyu, Senior Managing Partner of McKinsey Global and Head of McKinsey China Automotive Consulting Business, believes that "under the wave of Chinese companies going global, successful ones are still a minority, and we are still in the early stage of exploration where we need to pay tuition fees; the core challenge of Chinese car companies is to transform from 'multinational companies' with overseas business to truly integrated' global companies'. Past success stems from a precise grasp of the trend of electrification and winning at a fast pace; and the key to future success lies in whether a truly global and replicable operation and management system can be built. This requires business leaders to have forward-looking strategic layout ability and find the best balance between global unity and regional flexibility. The new journey towards 2030 will be a comprehensive upgrade competition from product strength to comprehensive ecological capability

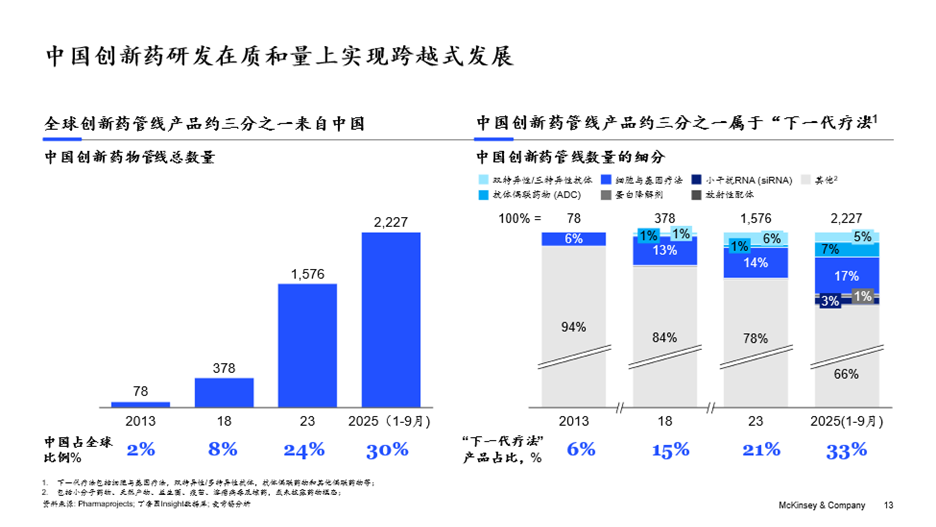

In the past decade, China's innovative drug research and development in the life sciences industry has achieved a leapfrog development in both quality and quantity, ushering in a milestone breakthrough: currently, about one-third of the global innovative drug pipeline products come from China, and about one-third of these innovative drug pipeline products from China belong to the next generation of cutting-edge therapies (such as cell and gene therapy, bispecific/multispecific antibodies). This achievement is driven by policy support, talent reserves, agile management, and a mature innovation ecosystem.

The globalization process of Chinese pharmaceutical companies also needs to enter a new stage, achieving an advancement from "developing innovative products with global competitiveness" to "building innovative enterprises with global layout". At the product level, innovative products developed in China over the past five years have entered the international market. A total of 23 drugs have been recognized as breakthrough therapies by the US FDA, and 11 have been approved for marketing by the US FDA. At the enterprise level, the internationalization of Chinese innovative pharmaceutical companies is still in its early stages. Only two of the top 30 global pharmaceutical companies with innovative drug revenue in 2024 were founded in China. Wang Jin, Senior Managing Partner of McKinsey Global and Head of McKinsey China's Life Sciences and Healthcare Consulting Business, stated that in order to truly become a global enterprise, Chinese pharmaceutical companies need to achieve three major strategic upgrades - from 'talent specialization' to 'talent globalization and diversification', from 'efficient decision-making' to 'both agility and stability', and from 'following innovation' to 'source innovation'. Specifically, Chinese pharmaceutical companies need to make efforts in the three dimensions of talent, organizational management, and innovation capabilities to achieve fundamental transformation: in terms of talent, in the past decade, they mainly rely on internal training and recruitment of Chinese scientists with overseas experience, and in the future, they need to vigorously attract management talents with leadership in multicultural organizations; In organizational management, it is necessary to upgrade from an efficient but centralized decision-making model to a systematic and institutionalized global management system that combines agility and stability to achieve greater risk tolerance; At the innovation level, it is even more important to go beyond existing technological iterations, actively explore upstream mechanism innovation and new development paths, and create differentiated products based on the unmet clinical needs of patients worldwide. This series of changes will help Chinese pharmaceutical companies truly achieve a qualitative leap from 'going global' to 'integrating with the sea'

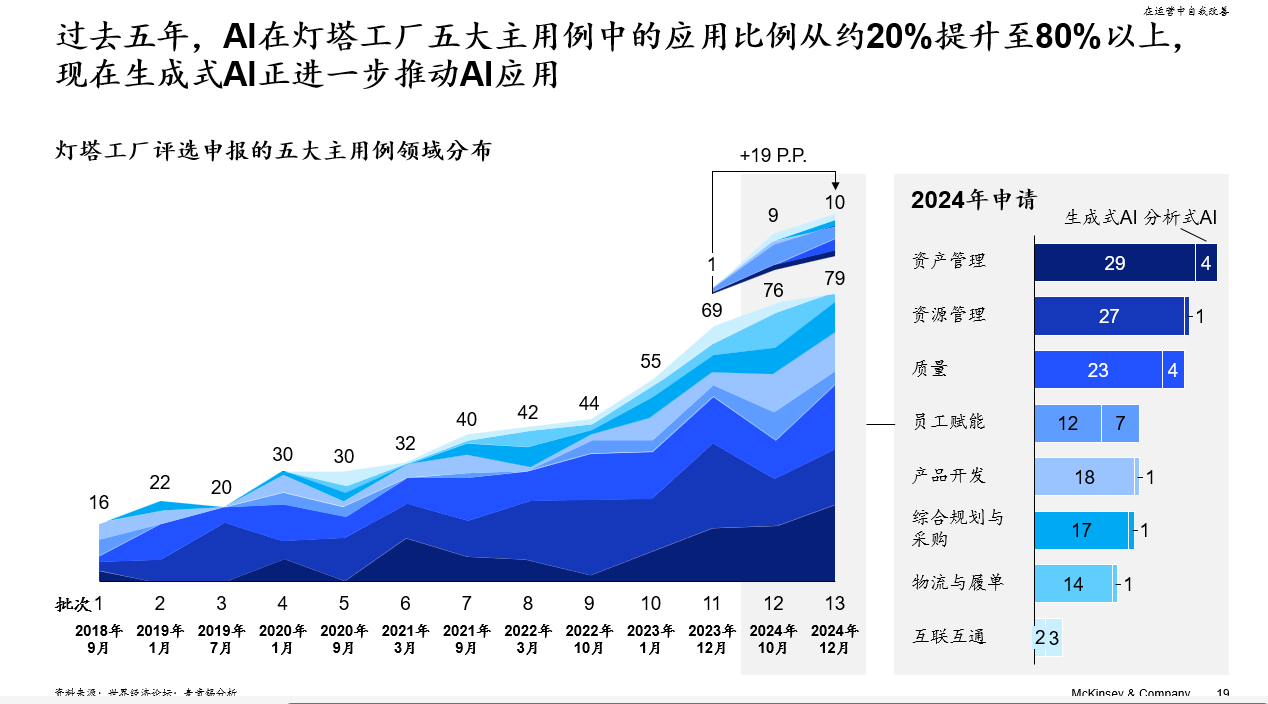

Key trends and potential opportunities in core industries. Currently, China has evolved from a massive "world factory" to an indispensable strategic market and innovation hub for advanced industrial enterprises worldwide. Chinese industrial enterprises have achieved leapfrog development in global manufacturing and innovation through the application of technology. At the same time, China's vibrant industrial ecosystem is attracting multinational corporations to use it as an "innovation accelerator", reshaping their competitiveness globally through deep participation and cooperation. The leading enterprises in China's manufacturing industry, especially the "Lighthouse Factory", are continuously expanding their leading advantages through deep integration of cutting-edge technologies such as digitalization, artificial intelligence, and industrial Internet of Things. Data shows that in the top five application scenarios of Lighthouse Factory, the penetration rate of artificial intelligence has increased from about 20% to over 80% in the past five years, and the rise of generative AI is further driving technology applications to new heights. Multinational companies operating in China are actively utilizing the Chinese ecosystem to accelerate their innovation. These enterprises are learning from the experience of local innovators in China to update their innovative operation mode from three aspects: setting high goals in multiple dimensions and achieving leapfrog development; Build a fast-paced problem-solving and execution culture, with senior management leading by example; Fully integrate into the local ecosystem and achieve end-to-end value reshaping.

Karel, Senior Managing Partner at McKinsey Global and Head of Human Resources, Organization, and Performance Consulting for McKinsey China

Eloot stated, "The competition in the digital field is an accelerating race where the strong remain strong, and the performance gap between the leaders and the laggards is rapidly widening. Leading Chinese companies pursue the ultimate goals of cost, performance, speed, and investment in all aspects, relying on rapid decision-making and innovative models that iterate in the market. For multinational companies, if they want to learn the speed and mode of the Chinese market, the important way is to increase investment and fully integrate into its ecosystem; doing nothing is essentially equivalent to choosing to exit. For many ambitious companies around the world, China is no longer an 'optional market', but a 'must compete place'. Here, companies can not only experience the world's most cutting-edge manufacturing technology and the most intense market competition, but also leverage the local ecosystem. Promote global innovation. Whether a company can succeed in the Chinese market is increasingly becoming a key benchmark for testing its global competitiveness

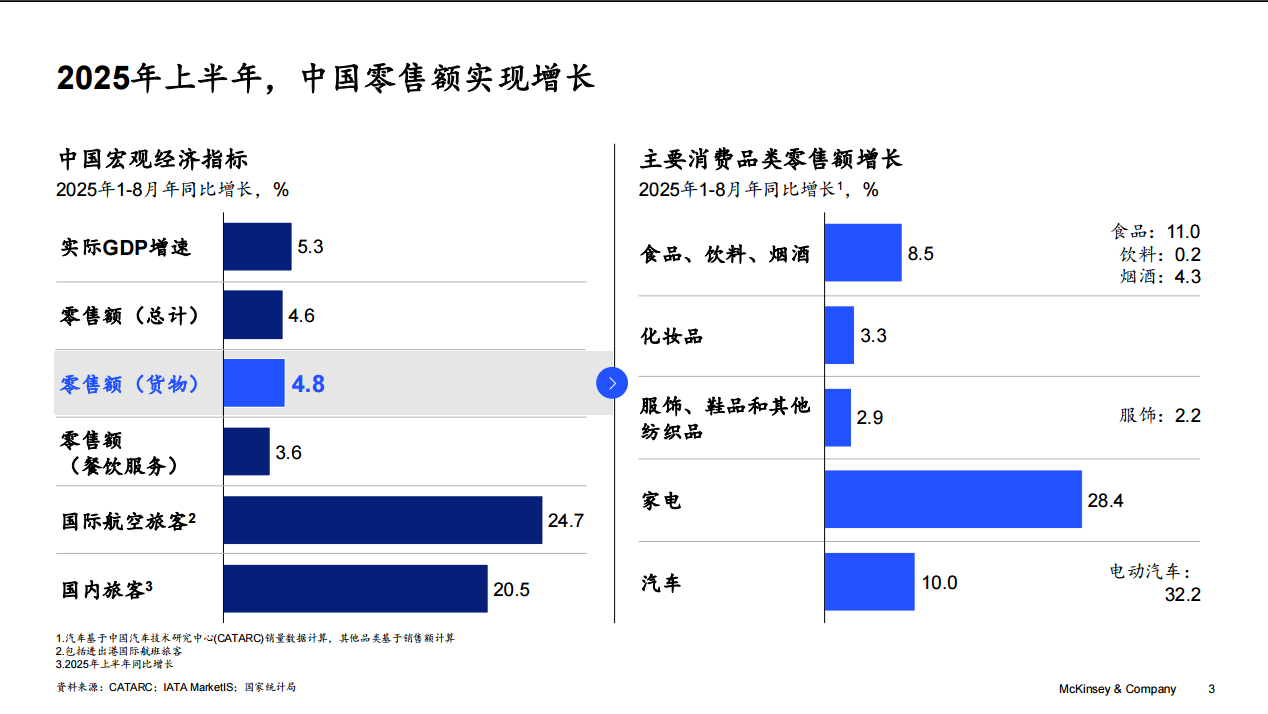

The middle class in China's consumer goods industry is gradually expanding, and its potential remains stable. It is expected that by 2030, the number of middle - and high-income households (with an annual income greater than 170000 yuan) will reach 259 million, accounting for 62%, gradually becoming the mainstream group of urban households in China. However, at the same time, the development of China's aging population and the decline in the number of newborns are also limiting factors. It is expected that by 2050, the proportion of people aged 65 and above will increase to about 31%; And the annual birth rate is also decreasing year by year. In 2025, Chinese consumption will demonstrate resilience. From January to August 2025, China's retail sales increased by 4.6% year-on-year, with home appliance sales growing by 28.4% and electric vehicle sales growing by 32.2%, becoming an important driving force for consumption; At the same time, the food, beverage, tobacco, and alcohol categories also maintained steady growth, with an increase of 8.5%. Despite a historic low in consumer confidence, Gen Z and consumers in third - and fourth tier cities remain relatively more optimistic. Resident savings have reached a new high, and Chinese consumers are still enthusiastic about depositing money in banks. In the first half of this year, the total savings of Chinese residents reached 163 trillion yuan, and the personal savings rate has remained above 30% since 2020. The key to stimulating consumption lies in how to transform "high savings" into "willingness to consume".

At the same time, e-commerce platforms actively layout instant e-commerce, promoting its upgrade from the 1.0 model centered on fresh produce to the 2.0 model covering all categories. This transformation not only expands new categories such as food and beverage, digital home appliances, clothing and beauty, but also activates "late night consumption", "instant travel gifts", and "instant gatherings"

Waiting for new scenarios to drive the industry from traffic competition to value cultivation has become an important driving force for e-commerce growth. Wang Wei, Senior Managing Partner of McKinsey Global, Digital Consulting Leader of McKinsey Asia, and Global Co Leader of McKinsey Global E-commerce Consulting, pointed out that "although public opinion often focuses on difficulties, some little-known deep changes are quietly reshaping China's consumption habits, innovation paths, and global competitiveness. The strong recovery of the tourism industry, optimistic expectations of young people for the economy, gradual recovery of the capital market, further accumulation of household savings, and activation of new consumption scenarios in interest e-commerce, value e-commerce, and instant e-commerce are jointly creating new growth momentum. These changes not only reflect the deep resilience of the economic system, but also open up new space for the next stage of growth. For enterprises, only by understanding these trends and integrating into the new consumption ecology can they grasp growth and achieve breakthroughs. '' Challenges still exist, but Chinese consumption is showing vitality. For enterprises that embrace change and continuous innovation, this market still harbors new growth opportunities.

How to build a century old store? As McKinsey celebrates its 40th anniversary in China and is about to celebrate its centenary in 2026, McKinsey invited Wu Yibing, Chairman of Temasek China, as a special guest to participate in a fireplace conversation with Ni Yili, Chairman of McKinsey China. The two guests had a deep discussion on how to successfully build a century old store in the next stage of the Chinese market.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!